A Clear, Personalized Roadmap for Your Retirement

Stop guessing about your financial future. Our service provides a data-driven presentation that models different retirement scenarios, helping you understand your numbers so you can make informed decisions.

Professional-Grade Planning, Without the Premium Price

Many of the planning tools featured by financial educators online rely on expensive, third-party software—costs that are ultimately passed on to you. We took a different approach.

We built our own proprietary planner from the ground up.

It's not based on opinion; it's built on the same powerful mathematical formulas and Canadian tax rules used by professional-grade software. By avoiding hefty licensing fees, we can provide you with a clear, data-driven roadmap for a fraction of the traditional cost. Our goal is simple: to democratize financial planning and give every Canadian access to the numbers they need to make smart decisions.

See the Clarity for Yourself

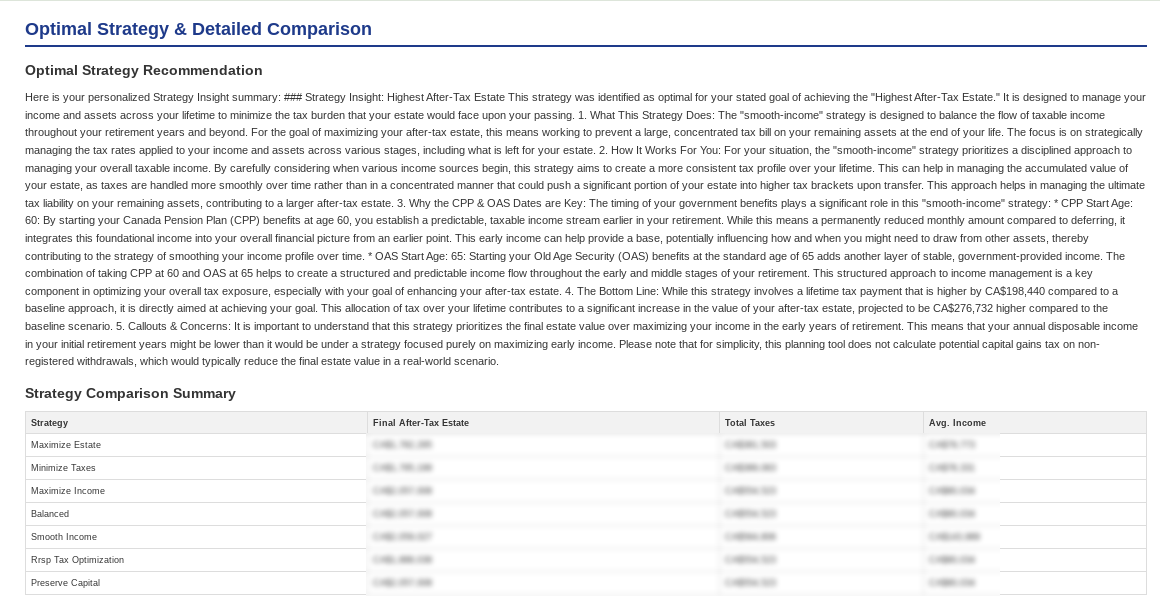

Your personalized report is a clear, easy-to-understand PDF that turns complex data into a straightforward roadmap. You'll see detailed comparisons of different strategies and a year-by-year projection, empowering you to make the best decisions for your future.

Our Simple 4-Step Process

From start to finish, the process is designed to be simple, transparent, and focused on you.

Choose Your Plan

Select the plan that best fits your needs—Single or Couple—and get started.

Complete Your Questionnaire

You'll receive a secure, confidential questionnaire to gather all the necessary financial data.

We Develop Your Custom Plan

I personally run your numbers through the planner to model different scenarios and identify optimal strategies.

Receive Your Data Presentation

You'll get a comprehensive, easy-to-read PDF report showing your projections and strategy comparisons.

From Uncertainty to Confidence: A Case Study

See how a data-driven plan made a life-changing difference for a real couple.

Meet John and Mary. They had saved diligently their whole lives, accumulating $800,000 in RRSPs and $150,000 in TFSAs. Their goal was to retire at 65 and live comfortably, but they were worried about making their money last and avoiding the infamous "RRSP tax bomb."

The "Default" Plan vs. The Optimized Plan

Their initial instinct was to take CPP/OAS at 65 and leave their large RRSPs untouched. We ran this as their Baseline Scenario. Then, we used the planner to find a more tax-efficient path. The optimized plan involved delaying CPP/OAS to 70 and strategically "melting down" their RRSPs during their low-income bridge years.

The Side-by-Side Comparison: A Shocking Difference

The results of simply changing the timing and order of their income sources were staggering.

| Metric | Baseline "Default" Plan | Optimized Plan | Improvement |

|---|---|---|---|

| Final After-Tax Estate | $915,000 | $1,150,000 | +$235,000 |

| Total Lifetime Taxes Paid | $550,000 | $410,000 | -$140,000 |

This is the exact type of powerful, data-driven analysis our Retirement Plan service provides. We help you navigate the complexities of retirement income to make decisions with confidence.

My Commitment to Clarity

Please note that I am not a licensed CPA or financial advisor and I do not provide financial advice. My role is as a data analyst and educator. The report you receive is a powerful educational tool based on the data you provide. It is designed to help you understand your financial picture so that you can make your own informed decisions, ideally in consultation with a licensed professional.

Our 14-Day Satisfaction Guarantee

My goal is to provide you with a clear, accurate, and easy-to-understand data presentation. If you are not satisfied with the quality and clarity of the report you receive, simply contact me within 14 days of delivery for a full refund. I stand behind the quality of my analysis.

Choose Your Plan

Limited Time Promotional Pricing!

Single Person Plan

$50

A comprehensive data presentation for one individual's retirement plan.

- Detailed Scenario Modeling

- Strategy Comparison Report

- Year-by-Year Projections

Couple's Plan

$75

A comprehensive data presentation for a couple, modeling your combined financial future.

- Everything in Single Plan, plus:

- Spousal & Survivor Scenarios

- Income Splitting Analysis